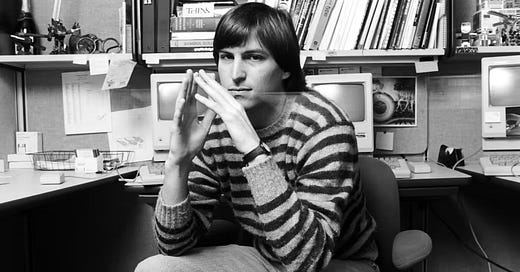

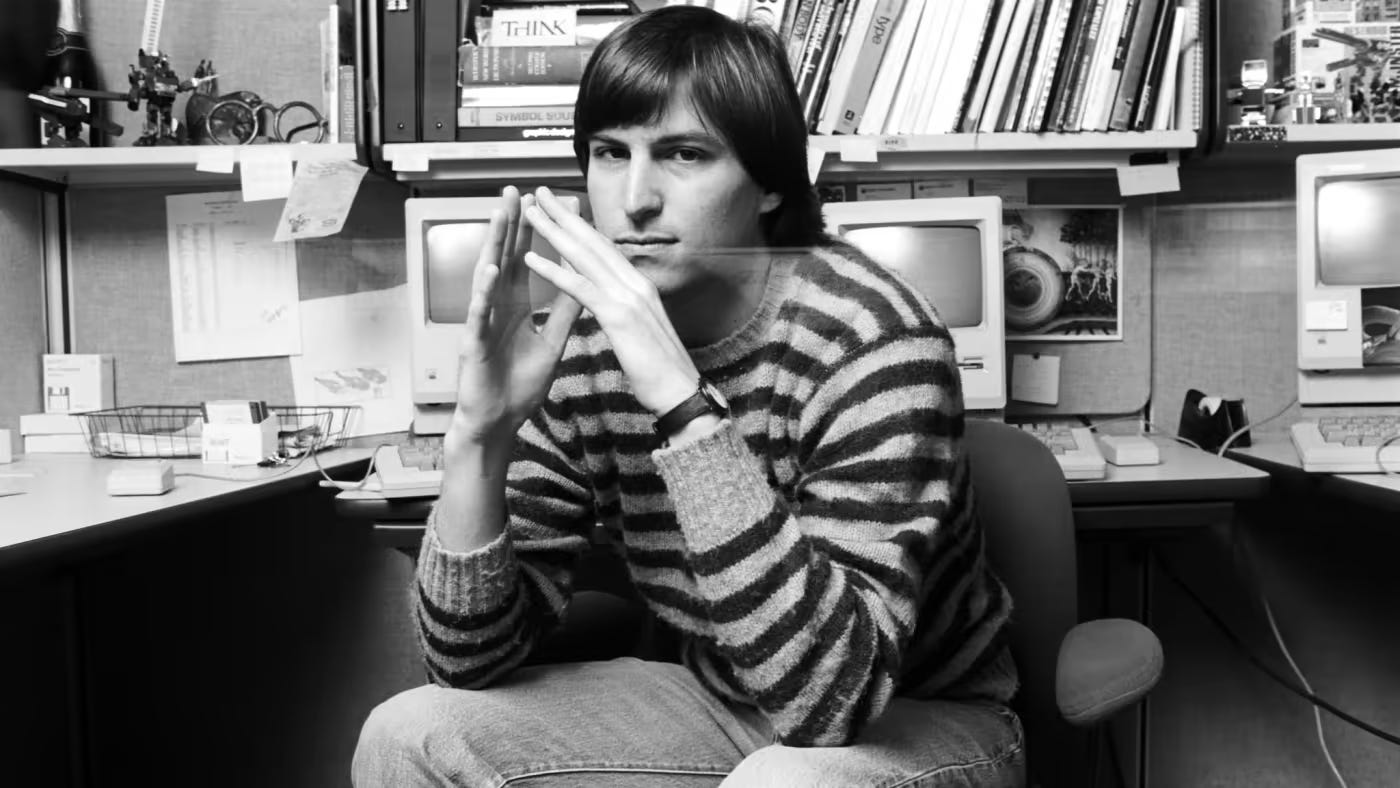

"It is easy to forget that, when he was a student, the man who brought us the Macintosh, iPhone and iPad (and, with his little finger, Pixar) collected bottle caps to make ends meet. The need to stretch every nickel informed the way Apple was run during the early days."

In 2015, Mike Moritz wrote an opinion piece for The Financial Times called "Imitators take note — Steve Jobs was more than a showman." It's a great reminder that the best businesses — including Apple — are the most capital efficient businesses. That what matters isn't how much you raise, but the business you build with what you raise. And that even Apple, started out life being incredibly cheap and capital efficient.

Being frugal and stretching every nickel ensures that your business is as durable as possible. While revenue will always ebb and flow, expenses are typically subject to inertia. Expenses tend to build up invisibly, almost imperceptibly, and can require heroic acts to shrink. While is why it's so important to build a culture of frugality from Day One — ensuring that as many dollars spent as possible go toward strategic expenses that sustain and grow your business.

Jump to any section:

Listen now

Read the essay

Who is Michael Moritz?

See also…

Video version

Listen now

You can listen to the full episode below and subscribe to the podcast so you never miss an episode.

Read the essay

Here is Michael Moritz's reminder that even Apple started life stretching every nickel:

It is easy to forget that, when he was a student, the man who brought us the Macintosh, iPhone and iPad (and, with his little finger, Pixar) collected bottle caps to make ends meet. The need to stretch every nickel informed the way Apple was run during the early days. It is on that spell, rather than the enormous public profile commanded by Steve Jobs in his later years, that would-be emulators should dwell.

Lost in the millions of words devoted to Jobs since his sad and untimely death is what established Apple in the first place — an approach to business far removed from the techniques employed by the managers of the three- or four-year-old subprime “unicorns” that command billion-dollar valuations today.

Peruse Apple’s initial public offering prospectus, and the numbers are startling. In the year preceding its flotation in 1980 Apple recorded sales of $117m, and pre-tax income of $24m. It did this in a market cluttered with dozens of companies making personal computers and with a payroll of about 1,000 — almost half of whom, believe it or not, were engaged in manufacturing. Apple’s initial public offering, which raised $90m, valued the company at about $1.2bn. (Multiply these numbers by three if you are comparing them with current dollars). Apple’s two founders and their chosen chief executive owned about 40 per cent of their creation, largely because they had been so efficient (and parsimonious) with the small amount of outside capital they had raised. Apple became a public company in a month when the prime rate stood at 21.5 per cent (yes, the decimal point is in the correct position) and the capital markets were bruising.

All this is most germane in the era of the subprime unicorn because the habits adopted during the formative years of a company have such an influence on its eventual operating performance. Apple’s tone in its early years was influenced not just by Jobs but by a management team composed of several alumni of the semiconductor industry — a milieu where the consequences of an operating mistake are harsh.

Some will argue that Apple’s lineage is irrelevant and, in some respects, they are right. Open source software and Amazon Web Services make it far easier and cheaper to start a company, or at least build a product, than it was when Jobs co-founded his business. On the flip side, at least in Silicon Valley, it is also more difficult and expensive to build a company up than it was at the end of the 1970s and early 1980s.

In Silicon Valley, it is more difficult and expensive to build a company up than it was at the end of the 1970s and early 1980s

The fact that there are more technology behemoths — Amazon, Apple, Google, Facebook, Microsoft — than at any time in history makes life tougher for the start-ups. These companies, together with a raft of smaller, rapidly growing, profitable ones (and, increasingly, several Chinese businesses with Silicon Valley outposts) are run by people eager to conquer new frontiers. That has had a dramatic effect on the cost of start-up labour.

Every capable person, whether their forte is engineering or sales and marketing, will be keenly fought over; and the large companies, with their ample profit margins and huge cash-flows, are prepared to pay king’s ransoms to retain their best and brightest or recruit the smart graduates. Add to that a large rise in the cost of property and the look-a-like companies sprouting up all over the world, and it is clear Silicon Valley is more expensive, in real dollars, than 40 years ago.

None of this means that the laws of business have suddenly been reversed. That Apple is now the world’s mightiest company is because its principal founder (and re-inventor) was always aware that his large public profile rested atop a meticulous operating machine — something that those who aspire to replicate his success might bear in mind.

This article (Imitators take note — Steve Jobs was more than a showman) was originally published in the opinion page of The Financial Times.

Who is Michael Moritz?

Michael Moritz is most well known as a venture capital, who led Sequoia Capital as their long-time Chairman and Partner. While at Sequoia he led investments into Google, YouTube, PayPal, and Stripe among others. But he started his career as a journalist and worked as a Staff Writer at Time magazine. While there, he got to know Steve Jobs well and was actually hired by Steve to document the development of the Mac and be Apple’s historian. Based on that work, Michael wrote the very first book ever published on Apple — The Little Kingdom: Steve Jobs, The Creation of Apple and How it Changed the World.

Steve Jobs eventually broke off all ties with Michael Moritz after a piece came out that he disliked. But Michael Moritz got to know Steve incredibly well, saw the development of the Mac first-hand, and wrote a book on Apple’s early days that’s still considered one of the best books on Apple ever written. Which I’ll be covering soon as a Book Breakdown.

See also…

For more on Steve Jobs, check out the following:

Book Breakdown: “Insanely Simple: The Obsession That Drives Apple's Success”

Book Breakdown: “Finding the Next Steve Jobs: How to Find, Keep, and Nurture Creative Talent”

Hope you enjoy this breakdown,

Daniel Scrivner

Founder of Ligature: The Design VC

p.s. You can also watch me break down this essay on YouTube and subscribe so you never miss a video.

Share this post