The Secret to Eternal Life in Business

Welcome to another edition of Cheat Sheet by Outlier Academy. Each week, we compress 6+ hours of research and interviews into 3 big ideas that you can read in 5 minutes.

This week we profiled Worm Capital, who call themselves “value investors focused on the future.” They’re one of our favorite technology and disruption investors in the public markets. Since Worm’s inception in 2012, they’ve outperformed the S&P 500 by over 2X net of fees—generating 26.73% per annum vs the S&P 500’s 12.08%).

Here are the 3 big ideas in this week's Cheat Sheet:

Markets provide liquidity, businesses generate value. Or why the game of business has nothing to do with the stock market.

How to find the best company in any industry. First observe, then deconstruct inputs and outputs.

The secret to eternal life in business. Or why the company that delivers the best customer value proposition consistently always wins.

PRINCIPLE

Markets provide liquidity, businesses generate value. Or why the game of business has nothing to do with the stock market.

Worm Capital likes to say that the game of business and the stock market have nothing to do with one another.

As an analogy Arnie Alsin, Worm’s Founder and Chief Investment Officer, says “Getting excited about the stock market is like getting excited by the ticket office at the Kentucky Derby. The ticket office is where you go to make bids, to increase your position, or cash in your bets. All of the real action happens out on the track. That’s where the race is won or lost.”

So it should be no surprise that Worm spends 2% of their time on the stock market and 98% of it researching and deconstructing businesses. In their view, the stock market is only where they go to increase or decrease their positions. Outside of that, there’s no useful data and information there.

The real action is in the game of business. Arnie says “When I look at business, it just screams game. It’s a game of strategy. You have competition between teams. Enormous stakes—trillions and trillions of dollars.”

He describes business as “An intense competition that happens one transaction at a time—which revolves entirely around the customer value proposition. With each transaction, the customer is making a choice—whether to keep their dollars or trade them for a given value proposition. The only way to ensure your survival in business is to deliver the best value proposition to customers.”

Worm views competition between companies as a massive game of strategy. Home Depot and Lowes are, at the end of the day, simply different teams competing against one another to win over and retain as many customers as possible. And at the heart of that competition lies the value proposition each company can make and deliver to their customers.

Ultimately, the best value proposition wins out. And what matters isn’t what companies promise, but what they can promise and deliver consistently.

That’s how you build value in a business. So Worm’s job is to find the companies that can do just that. Knowing that if they own a piece of a fabulous business, that this should be reflected in the stock price.

FRAMEWORK

How to find the best company in any industry. First observe, then deconstruct inputs and outputs.

One of my favorite things about Worm Capital is that they run an incredibly concentrated portfolio—typically holding between 4-12 positions. And they know, in painstaking detail, how each of those businesses work, why they work, and why they are the right team to bet on in a space.

They also track another 200 companies across public and private markets. Which they use as a sort of map of what industries they need to be studying. They’re constantly refreshing their knowledge of industries and learning new ones to find the one player to bet on within a given space.

Which has given them superhuman powers at being able to quickly understand a market or industry and deconstruct how businesses work from top to bottom.

They have their own two-step research process for doing this that I found fascinating. They call those steps The Jane Goodall Approach and Elon Musk The Engineer.

Step 1: The Jane Goodall Approach

As Eric Markowitz, Worm’s Head of Research, describes it “Step one is what we call The Jane Goodall Approach. Which is you plant yourself on the hillside and you just watch the chimpanzees. You don’t have any opinions. You just watch them, take notes, and see how they interact with each other.”

In Worm’s view, when studying an industry or company you always have to start from a blank sheet—no opinions, no point of view; just open, curious, and observant. That’s how you avoid early errors in judgment.

Eric says “There’s a big difference between conviction and opinions. Conviction is great. Opinions are really bad, because opinions are what really screw you up.”

The first step is just raw data collection. Sketching out, quite literally, all the different companies in an industry. It’s about starting fresh, being intentionally naive and open minded, in order to allow yourself the time to develop deep conviction.

Step 2: Elon Musk The Engineer

If The Jane Goodall Approach is all about understanding the broader context, Elon Musk The Engineer is about taking things apart and putting them back together to understand how they work. It’s the engineering phase of the research process.

As Eric Markowitz says “Once we’ve sort of identified the dynamics of the industry, we spend as much time as possible understanding how the products are made. Taking something like Amazon, we ask: How does the seller system work? How do the actual platform dynamics work? Who makes money? What percentage?”

It’s all about demystifying a business—breaking it down as if it was a mechanical machine. It’s about understanding the inputs and outputs so you can identify which ones truly matter.

It has nothing to do with understanding how much a company like Amazon will make this quarter. That insight has a very short shelf life. Instead, Worm wants to understand the nitty gritty details of how the business works and why it works. Which is an insight that has a much longer shelf life.

PRINCIPLE

The secret to eternal life in business. Or why the company that delivers the best customer value proposition consistently always wins.

So after 10 years and 2X+ outperformance over the S&P 500, what is Worm’s secret for picking the best company in any industry?

Simple: They look for the company that can create and deliver the best value proposition to customers—consistently. Both today and tomorrow.

Because ultimately Worm believes that business is a fierce competition between companies that is won one transaction at a time. That’s why startups regularly topple entrenched players, it’s why the S&P 500 sees so much turnover from decade to decade. Ultimately the best value proposition, delivered consistently, wins—given enough time and money.

What’s challenging isn’t finding the company with the best value proposition today, it’s finding the company that will deliver the best value proposition of tomorrow.

To do that, Worm looks for companies “building the infrastructure today, to deliver the best value proposition to customers tomorrow.” Which is a lot harder to spot, because that looks like:

An online book seller investing millions to build out a new, entirely untested, developer services business which would become Amazon Web Services (AWS).

An electric car manufacturer burning billions building the factories, batteries, and technologies required to deliver hundreds of thousands of Tesla Model S/3/X/Y vehicles to customers each quarter.

A company whose mission is to “bring people closer every day” investing $15B+ per year into their vision of the metaverse—where they’ve had no real success to date, have burned over $50B+ on so far, and plan to continue doing in the face of an impending recession.

All of these were widely mocked and ridiculed, because they were investing ahead of demand. They were building the infrastructure today to deliver the best value proposition to customers tomorrow. Worm's ability to see through this fog of war and see the potential of what's being built during the heavy capital allocation phase has been key to their success.

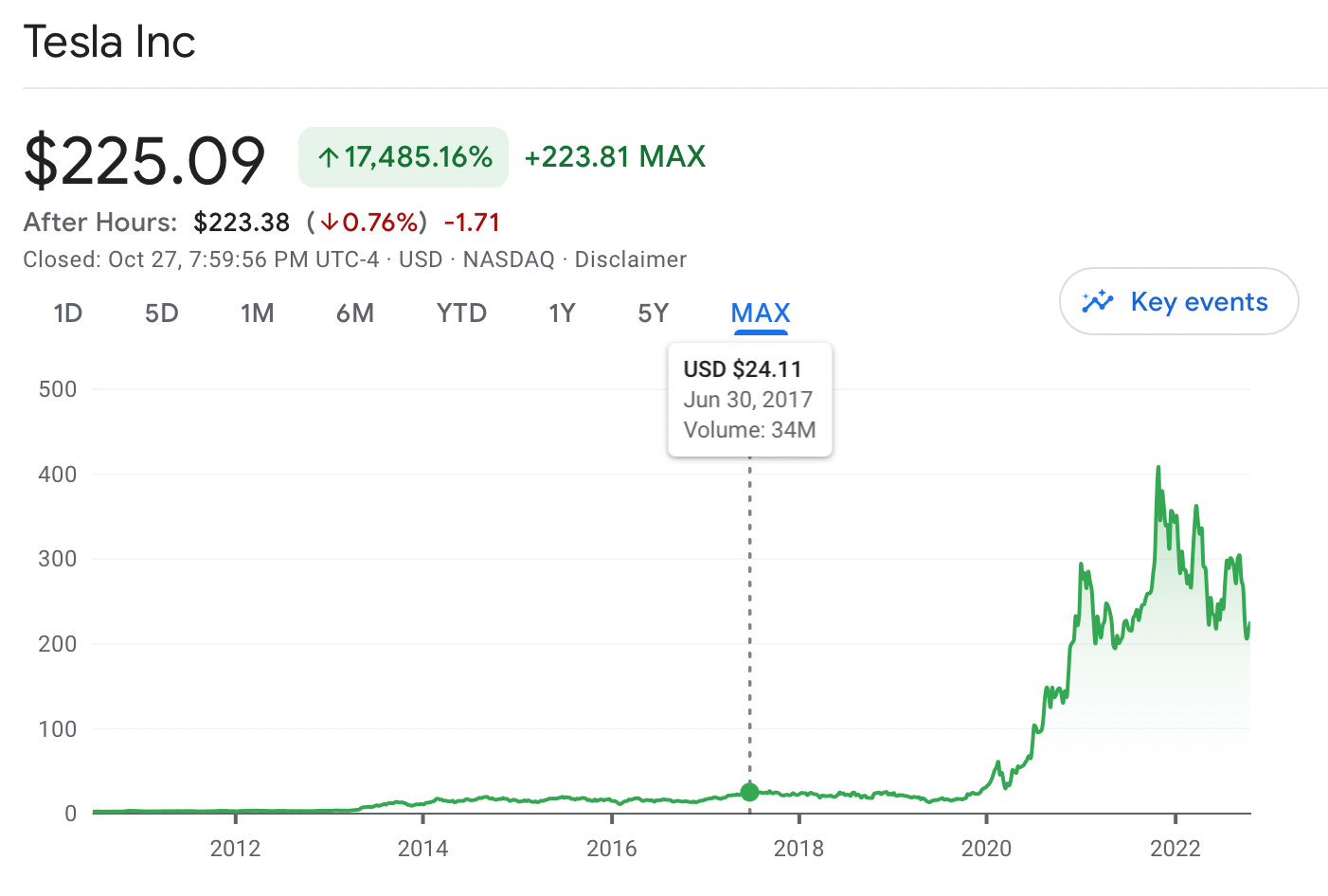

As an example of this, they’ve been investors in Tesla (TSLA) since early 2017—when they came to the conclusion that Tesla could design, engineer, manufacture, market, and deliver the world’s best electric cars. The type that consumers actually wanted to own and drive. That initial investment happened around here on Tesla’s historical price chart:

In 2017, Tesla traded between a price range of $14.06 and $25.97. Tesla continued to trade in that range until late 2019—a full two years later. After which time, it exploded in price and still trades above $200 per share today.

Worm’s ability to invest deep into Tesla’s cash burning trough, gain conviction to own it in size, and maintain that conviction through the volatility we’ve seen is impressive. Worm came to this conclusion years before other investors did and years before Tesla ever became a meme stock.

Eternal life in business is granted to those who can make the most compelling value proposition to customers and then deliver on it. Day after day, transaction after transaction.

As Eric Markowitz, Worm’s Head of Research, likes to say, “We can stomach quote risk, we can’t stomach business risk. We think the much bigger risk lies in owning companies that can’t deliver an incredible value proposition to customers.”

Until next week,

Daniel Scrivner

Creator of Outlier Academy

Listen, watch, or explore more of this week’s episodes:

20 Minute Playbook - Eric Markowitz, Worm Capital’s Head of Research | Conviction vs Opinions, Two-Step Research Process, Favorite Books, and More

Listen Now | Watch Now | Episode Guide | Transcript

Outlier Investors - Worm Capital: Value Investors Focused on the Future | On Worm Theory, Worm’s Investing Algorithm, and The Game of Business